Is the Labour Market ready for an interest rate cut?

With inflation down and unemployment up, is now the right time for the rate cut expected by so many?

19th April 2024

On April 16th, the Office for National Statistics (ONS) released its latest unemployment figures, revealing that as of the three months leading to February 2024, the UK's unemployment rate stands at 4.2%. While this figure is slightly above the previous month’s figure of 3.9%, it still represents a relative low point, tracing back to the inception of the Labour Force Survey in 1971. However, the recent uptick in unemployment has sparked discussions about whether the Bank of England may consider an interest rate cut to bolster a struggling economy.

Despite indicators suggesting a buoyant labour market, the UK economy finds itself grappling with recessionary pressures and persistently high inflation rates exceeding the Bank of England's target. Additionally, the UK continues to contend with one of the highest income inequality rates within the OECD. This contrast between low unemployment rates and economic challenges warrants a closer examination of the complexities within the UK labour market to determine whether the Bank’s assessment for interest rate decisions adequately captures the nuances.

Assessing the Full Story of Employment:

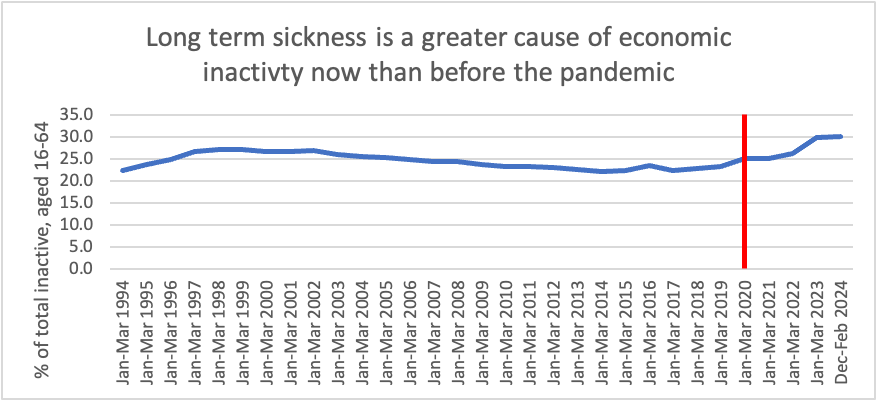

When evaluating the significance of high employment and low unemployment, several factors merit consideration. Inactivity rates are currently approximately 2 percentage points higher than before the pandemic. The rates of inactivity due to long-term health reasons have increased by around 5 percentage points since the onset of the pandemic, indicating a potential worsening trend and research from the Health Foundation suggests this problem may persist. This raises questions about whether the Bank's assessment of unemployment fully accounts for these individuals, and whether their increasing prevalence is masking an underlying problem in the labour market.

Source: ONS Labour Force Survey

While wages have risen when adjusted for inflation, there is still ground to cover before average real wages surpass pre-inflation levels. Although public and private sector wages currently show similar growth rates, this has not consistently been the case during periods of high inflation. Stagnant or declining incomes amid high employment levels suggest that the labour market's health isn't solely reflected by employment figures. It remains to be seen whether the recent decline in inflation rates may sway the Bank towards considering rate cuts to stimulate the economy.

Underemployment and Unstable Employment:

Stability and the number of desired work hours are crucial aspects often overlooked in the assessment of employment. Around 7% of employed individuals are considered underemployed, not working their desired number of hours. The prevalence of zero hours contracts has also dramatically increased, albeit from a relatively low base, posing challenges for income stability and contributing to socio-economic issues. The rising prevalence of these contracts may indicate underlying weaknesses in the economy, though the extent of their impact remains uncertain.

Source: ONS Labour Force Survey

Addressing Long-term Unemployment:

High rates of long-term unemployment, with 23% of the unemployed being so for more than 12 months, suggest a mismatch between workforce skills and available jobs. While this figure is lower than it was during recent recessions, it is on the increase and this might suggest that the labour market is starting to falter if more people are finding it hard to find any sort of employment.

Source: ONS Labour Force Survey

As the Monetary Policy Committee (MPC) convenes, the Bank of England faces the critical decision of balancing the risk of exacerbating inflation against the need to support a labour market that may be on the cusp of change. The recent decline in inflation, albeit influenced significantly by external factors, coupled with the nuanced challenges within the labour market, suggests that rate cuts aimed at stimulating investment could provide the necessary boost. However, addressing the long-term structural issues within the economy, particularly concerning education and workforce skills, remains paramount for sustainable growth. The government's failure to articulate a clear vision for the economy and the necessary skills underscores the need for comprehensive planning to navigate the challenges of the 21st century.

By delving deeper into the intricacies of the labour market and considering a holistic approach to economic policy, policymakers can better navigate the complexities of the current economic landscape and steer the UK towards long-term prosperity. Without this, they will continue to make decisions that are flawed from their inception.

©Copyright. All rights reserved.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details and accept the service to view the translations.